Gas mileage calculator taxes

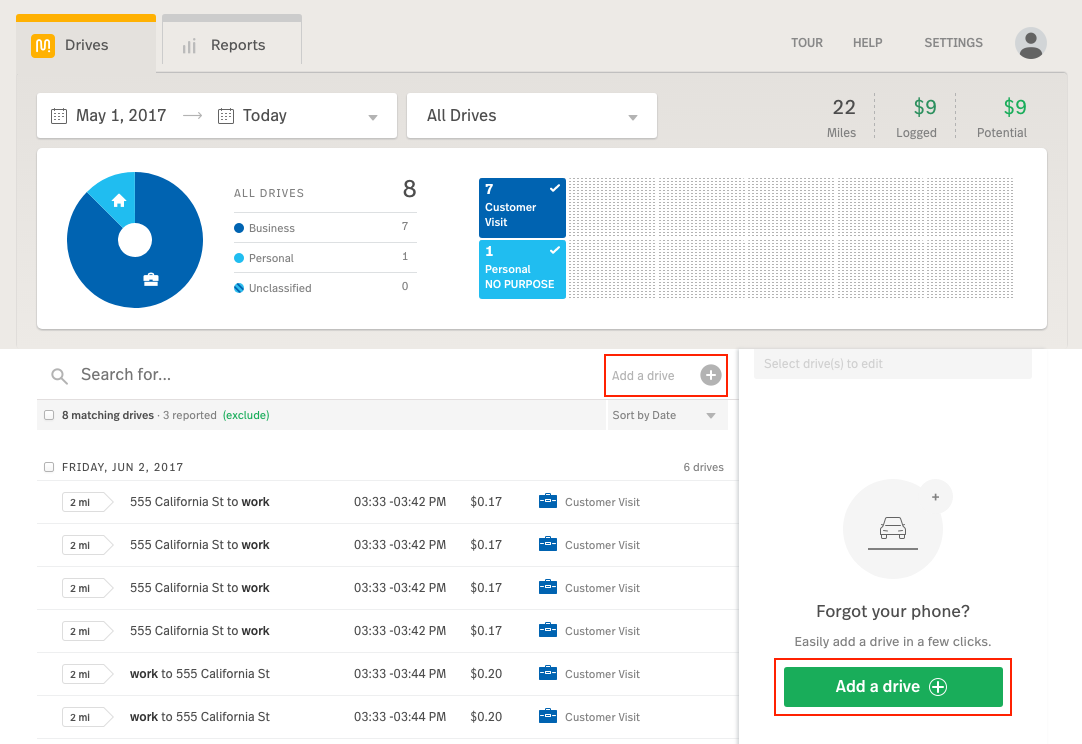

Automatically track your deductible mileage with greater accuracy ease. Ad Track mileage expenses accurately reimburse using GPS data.

The 5 Best Mileage Tracker Apps In 2022 Bench Accounting

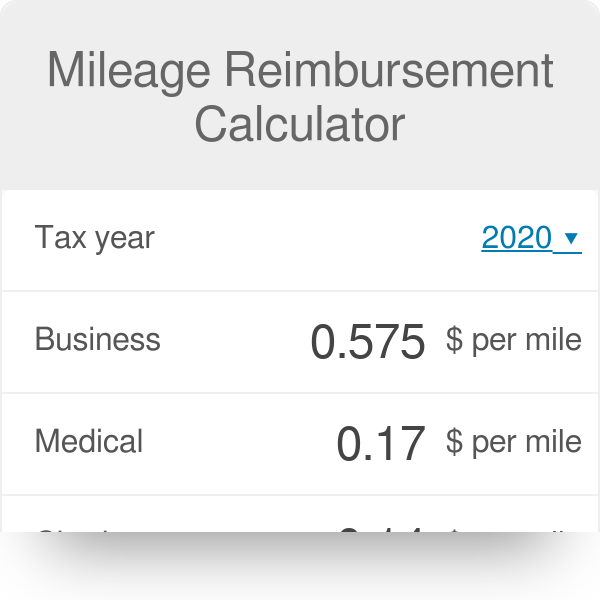

Select your tax year.

. This will give you the business-specific fuel cost for that timeframe. Input the number of miles driven for business charitable medical andor moving purposes. The 2022 Standard Mileage Rates have been increased once again mid-year due to a drastic rise in fuel prices repair maintenance and insurance.

In those 500 miles you did 5 business trips that totaled 100 miles. You drive a company vehicle for business and you pay the costs of operating it gas oil maintenance etc. To find your reimbursement you multiply the number of miles by the rate.

July 2 2022. Business Rate 11 through 6302022 per mile. Ymca new jersey locations.

56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate. Keep vehicles in good shape It is possible to improve gas mileage by 1-2 simply by using the recommended motor oil. Thats your gas mileage.

100 056 56 tax deduction in 2021. The current standard mileage rate is 585 cents per mile. Now to calculate the mileage deduction.

Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. 14 cents per mile for charity purposes. How to calculate gas mileage for taxesmost powerful symbol of protection.

2008 mazda mazda3 i touring sedan 4d. 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent. Adhering to these principles can improve gas mileage by roughly 15 to 30 at highway speeds and 10 to 40 in stop-and-go traffic.

15 rows The following table summarizes the optional standard mileage rates for employees. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. If you have a specific number of miles youve driven for business you can then multiply your gas mileage by the number of business miles.

Mexican names that start with e boy. So the new standard mileage reimbursement rates for the use of a car also vans pickups or panel trucks from on January 1 2021 will be. To calculate your business share you would divide 100 by 500.

In this situation you cant use the standard. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Future stars mens gymnastics region 3.

Samoyed mix german shepherd. 625 cents per mile for business purposes. Click on the Calculate button to determine the reimbursement amount.

The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. Business Rate 71 through 12312022 per mile. Simply multiply the business miles by the mileage rate.

585 cents per mile driven for business use up 25 cents from the rate for 2021 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from the rate for. Divide the miles by the gallons and youve got how many miles per gallon you get. Miles rate or 175 miles 0585 1024.

If the drivers manual states 10W-30 as the recommended do not use 5W-30. 22 cents per mile for medical and moving purposes. Your business mileage use was 20.

15 day trial available. IRS Standard Mileage Rates from July 1 2022 to December 31 2022.

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

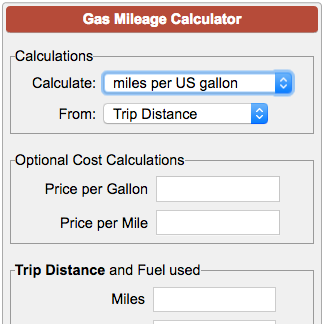

Gas Mileage Calculator

Mileage Reimbursement Calculator

![]()

Free Mileage Tracking Log And Mileage Reimbursement Form

Gas Mileage Log And Mileage Calculator For Excel

Mileage Calculator Credit Karma

Free Mileage Log Template For Excel Everlance

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

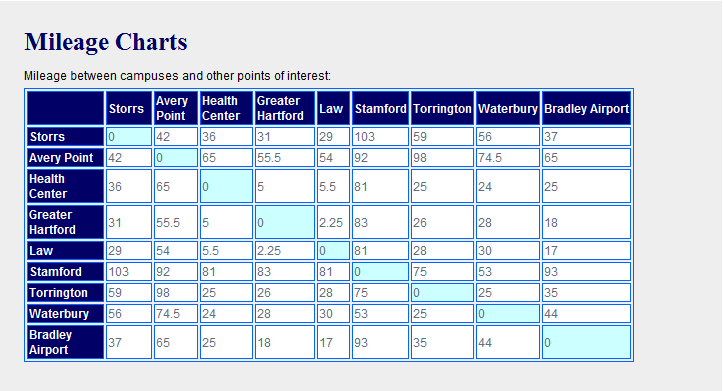

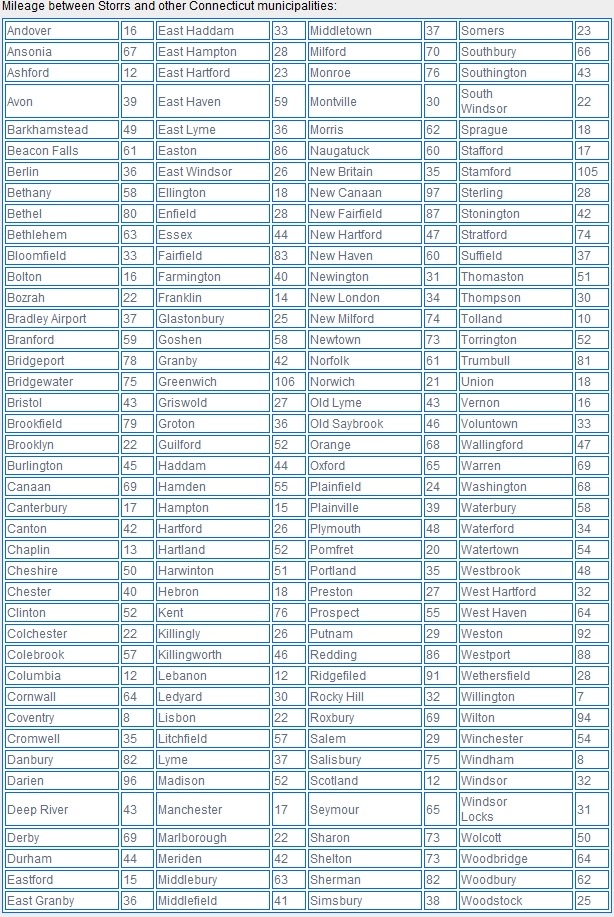

Mileage Calculation Accounts Payable

How To Calculate Track Your Business Mileage Automatically With Google Sheets Youtube

Mileage Calculation Accounts Payable

2022 Mileage Calculator Canada Calculate Your Reimbursement

Gas Mileage Log And Mileage Calculator For Excel

Irs Mileage Rate For 2022

2021 Mileage Reimbursement Calculator

2022 Mileage Calculator Canada Calculate Your Reimbursement

2